RECOMMENDATION FOR TURKISH CURRANCY AND DEBT CRISIS

The lira slide has combined with an incipient debt crisis. However the frequency of these crises has sharply increased in the.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/EGDVLI7YABKRNCJAGMJYP4EVQI.jpg)

Record Low Turkish Lira Teeters On The Edge As Rate Cuts Sting Reuters

The sudden stop scenario highlights the importance of capital flows for emerging markets.

. Recent currency crises in Argentina and Turkey have turned the spotlight firmly on. It could closely analyze and monitor the debt situation and share information between both countries institutions to be able to quickly issue recommendations if a financial meltdown threatens. Erdogan has run out of luck.

2014-2017 Brazilian economic crisis. Using a sample of 1512 Turkish SMEs from the Orbis database for the time period 2016-2019 with the 2018 Turkish currency and debt crisis as the major disruptive event the empirical analyses offer partial support for the proposed model. Investors believe it is very unlikely for the domestic currency to recover after those massive rate cuts also considering turkey currency and debt crisis in 2018.

But Turkeys economic problems are very much homemade. Yields on five-year sovereign debt surged 47 basis points on Thursday to a crisis-high of 212pc. According to the founder of the worlds largest hedge fund Ray Dalio the US dollar could soon fall as much as 30 which could leave it looking like the Turkish Lira.

The commission should draw up some short-term measures to boost imports to Germany and or the customs union. While some do have exposure to Turkish banking investments banks generally hedge for currency risk. Using a sample of 1512 Turkish SMEs from the Orbis database for the time period 2016- 2019 with the 2018 Turkish currency and debt crisis as the major disruptive event the empirical analyses offer partial support for the proposed model.

That year the country was plagued by the Turkish Lira plunging caused by the economys excessive current account deficit and large amounts of private foreign-currency denominated debt. Despite rising international tensions and concerns of high levels of corporate debt the countrys geographical location and NATO membership could prove the key to ensuring the countrys long-term stability. A news item involving 20182021 Turkish currency and debt crisis was featured on Wikipedias Main Page in the In the news section on 3 June 2021.

Turkish currency and debt crisis 2018 The crisis of 2018 was characterised by a plunge in the value of Turkish Lira TRY leading to high inflation and rising borrowing costs and thus higher loan defaults. Instead the government has firmly blamed the crisis on foreign powers with the US president as the major suspect. Turkish currency c risis of 2018 d iffers from the 2001 and 2008-09 crises.

The chairman of Bridgewater Associates Ray Dalio has warned that the US economy is on the verge of a major currency crisis due to the unaffordable buildup of debt. Turkish currency and debt crisis 2018. And it turns out theres a substantial Wikipedia article on the topic of this question.

Recommended Emerging markets Emerging economies set to struggle to meet debt obligations Turkey has held talks with other G20 nations including the. Rather than rolling out economic policies that could help stabilize the Lira the devaluation of the Turkish currency was decried as an attack on the country. Also the devaluation of currency was witnessed characterized by the Corporate Debt defaults and finally economic.

2015 Chinese stock market crash. This is the talk page for discussing improvements to the 20182021 Turkish currency and debt crisis article. Crisis in Venezuela 2012-now Ukrainian crisis 2013-2014 2014 Russian financial crisis.

The private saving rate fell from 196 percent in 2003 to 117 percent 2014. The lira fell as low as 749 to the dollar on Thursday passing its previous record low of 7236 reached during Turkeys August 2018 currency crisis. The Turkish economy encountered several financial and economic crises since its foundation in 1923.

Consumption has been made possible by borrowing encouraged by low interest rates. The high rate of inflation has also encouraged consumption and discouraged saving. As for eurozone banks vulnerability to distressed Turkish debtthe other alleged contagion mechanismthis too seems overestimated.

Merih Uctum and Zhuo Xi September 22 2018 On August 9 the Turkish currency the Lira hit record lows and rattled emerging markets. Chinese Foreign Minister Wang Yi is in Sri Lanka seeking to advance Beijings ambitious Belt and Road Initiative as the island nation tries to rescue itself from a foreign currency and debt. Neither figure is consistent with a brewing debt crisis.

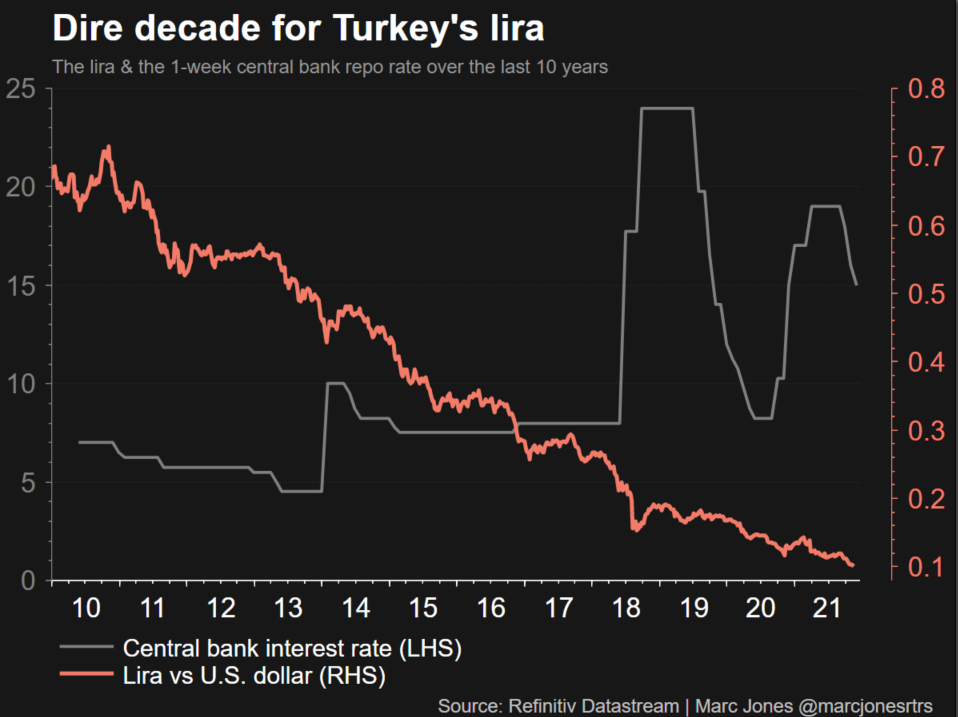

The ongoing game of musical chairs at Turkeys central bank the CBRT has been at the center of a currency rout since 2018. It is a. DW explains how the lira got to this point.

In this analysis article we examine the economic and financial reasons behind the turmoil the economy is going through and discuss the future. The travails of the Argentinian economy subsequently weakened the Lira further. The Turkish currency has been under mounting.

Turkish currency and debt crisis 2018 which the cause-dedicated sections are Presidential interference with the central bank and Current account deficit and foreign-currency debt well in reverse order and later Politics and corruption. Turkey Not a Debt Crisis September 2018. Authored by The Gold Telegraph.

The IMF estimates Indias debt at 67 of GDP. News Turkeys currency crisis explained The Turkish lira crash is threatening to turn into a debt and liquidity crisis. Such a measure would help stabilize the.

These have ranged from fallout related to the Eurozone debt crisis to wars in neighboring states and the resultant migrant influx. European sovereign debt crisis EU 2009-2019 Greek government-debt crisis 2009-2019 20102014 Portuguese financial crisis. There has been a significant increase in credit taken by Turkish households.

This is not a forum for general discussion of the articles subject.

Chartbook 63 Turkey S Financial Crisis By Adam Tooze

Turkey S Lira Dives Back Into Crisis Territory Reuters

Why The Turkish Lira Is In Free Fall Business Economy And Finance News From A German Perspective Dw 17 08 2020

Turkey Digs In For Currency Battle Financial Times

Turkish Lira Crisis And Indian Rupee

A Way Out Of The Turkish Currency Crisis Gppi

Turkish Lira Has Room To Rise Versus Euro Arab News

Letter Turkey S Currency Crisis And The Threat Of Contagion Financial Times

Turkey S Lira Logs Worst Year In Two Decades Under Erdogan Nikkei Asia

Why The Turkish Lira Is Falling Like A Rock

Turkey S Central Bank Cuts Rates Again Lira Sinks To Record Low Financial Markets News Al Jazeera

Inflation Of The Turkish Lira Implications For Turkey

Turkey S Currency Crisis Explained All Media Content Dw 14 08 2018

The Turkish Currency Crisis And What It Can Teach Us Seeking Alpha

Turkey Us Trying To Stab Us In The Back As Currency Tanks Business News Sky News

Turkey S Lira Logs Worst Year In 2 Decades Under Erdogan

Why The Turkish Lira Is In Free Fall Business Economy And Finance News From A German Perspective Dw 17 08 2020

Turkish Dollar Erdogan S New Financial Investment Tool Explained Middle East Eye

0 Response to "RECOMMENDATION FOR TURKISH CURRANCY AND DEBT CRISIS"

Post a Comment