Unearned Revenue Journal Entry

Unearned revenue should be entered into your journal as a credit to the unearned revenue account and as a debit to the cash account. In that event the company.

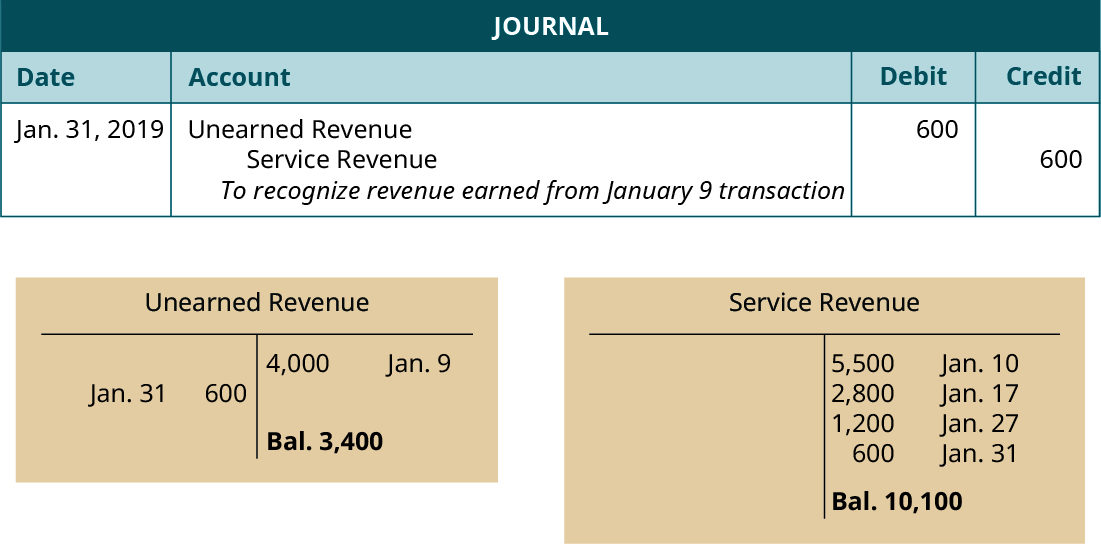

1 10 Adjusting Entry Examples Financial And Managerial Accounting

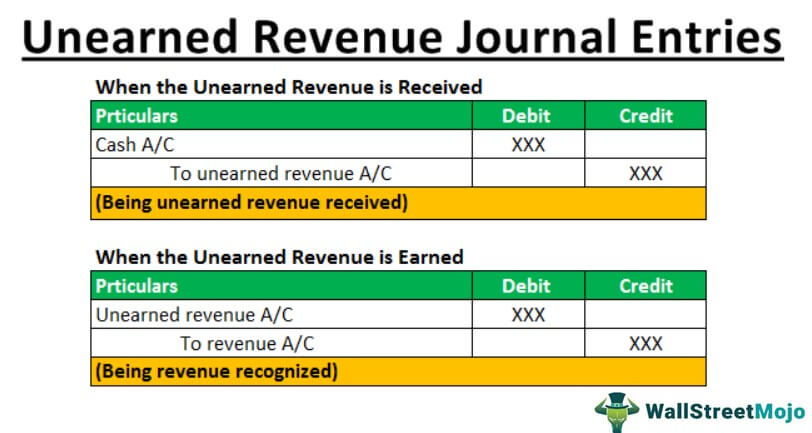

Companies record the journal entries for unearned revenues in two cases.

. Companies record the journal entries for unearned revenues in two cases. The journal entry to report unearned or deferred revenue in the books of a company is as follows. To Subscription Receivable Ac Cr 240.

At the end of each accounting period adjusting entries must be made to recognize the portion of unearned revenues that have been earned during the period. The first involves the receipt of the advance from the customer. To record the cash receipt in advance.

You might also know it as unearned revenue. Cash DR xx Unearned Revenue CR xx. The stagewise journal entries will be as follows.

The unearned amount and the organizations revenue are both credited when they are written as journal entries. After performance of the first months services the liability. One month the company can recognize revenue for that period by transferring the amount in the unearned rent revenue account to the rent revenue account at.

Unearned revenues normally are current liabilities. To Unearned revenue Ac Cr 240 b Bank Account Dr 240. Unearned subscription revenue is recognized when cash is received at the beginning of the subscription period.

Unearned revenue should be entered into your journal as a credit to the unearned revenue account and a debit to the cash account. When the services are performed revenue is then earned and the following journal entry is required. This accounting treatment is crucial under accounting standards.

EXAMPLE 1 Unearned Professional Fees On January 1 a client made an advance payment of 1000 for professional fees to be rendered over the next four months. A Subscription Receivable Ac Dr 240. The adjusting entry if the liability method was used is.

If you are using accrual-based accounting revenue is only recognized when it is earned. Unearned revenue usually occurs in subscription-based trading or service industries where payments are taken in. Unearned subscription revenue is a liability account.

Invoice raised and money received for an annual subscription from Mr. Unearned revenue sometimes referred to as deferred revenue is payment received by a company from a customer for products or services that will be delivered at some point in the future. The term is used in accrual accounting in which revenue is recognized only when the payment has been received by a company AND the products or services have not yet.

This process is referred to as deferred revenue recognition. However the unearned value must be adjusted when the organization finishes the transaction and earns the revenue. Up to 24 cash back If the company does not deliver the goods or services the unearned revenues will continue appearing in the balance sheet.

Journal Entries for Unearned Revenue. Journal Entries for Unearned Revenue. These approaches are called the Income Method and the Liability method and both offer ways to record journal entries for unearned income.

Unearned revenue is recognized as a current liability on the balance sheet. What are the journal entries to be prepared on December 1 and 31 201. What are the journal entries for Unearned Revenues.

Later when the rental property or equipment is used for a period of time eg. Dr Unearned revenue account Cr Income account for the amount earned. The unearned amount also ends up on the organizations statement of financial position under the current liabilities.

Companies can take one of two approaches with unearned revenue accounting. What Is the Journal Entry for Unearned Revenue. The deferred revenue journal entry is your tracking mechanism for this type of revenue within your accounting.

The first involves the receipt of the advance from the customer. Likewise this journal entry is made to recognize that the cash received from the early payment of rent is not revenue but an unearned revenue. Unearned revenues are payments for future services to be performed or goods to be delivered.

This journal entry illustrates that the business has received cash for a service but it has been earned on credit a prepayment for future goods or services rendered. 1 December 1 201. As the obligation related to the unearned revenue is delivered over time the liability decreases as the amount is transferred to revenue on the income statement.

This journal entry illustrates that your business has received cash for its service that is earned on credit and considered a prepayment for future goods or services rendered. What are the journal entries for Unearned Revenues. The adjusting entry for unearned revenue will depend upon the original journal entry whether it was recorded using the liability method or income method.

Any time your company receives payment for future goods or services this is deferred revenue. Advance customer payments for newspaper subscriptions or extended warranties are unearned revenues at the time of sale. In that event the company must create a liability in its balance sheet termed unearned revenues.

What Is The Adjusting Entry For Unearned Revenue Youtube

What Is Unearned Revenue Quickbooks Canada

0 Response to "Unearned Revenue Journal Entry"

Post a Comment